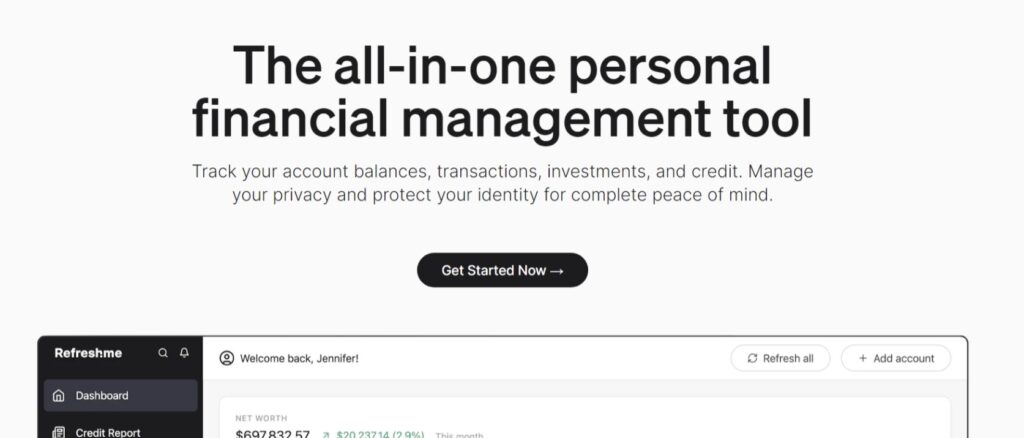

Benefits of Refresh.me

Credit Monitoring:

- Real-Time Updates: Users receive real-time updates on their credit scores and reports, helping them stay informed about any changes.

- Alerts: Alerts for any suspicious activity or changes in the credit report, enabling quick action to protect credit health.

Financial Planning Tools:

- Budgeting: Tools to create and manage budgets, track expenses, and set financial goals.

- Debt Management: Strategies and plans to manage and reduce debt effectively.

Personalized Advice:

- Credit Improvement Tips: Personalized tips and advice on how to improve credit scores based on individual financial situations.

- Educational Resources: Access to articles, tutorials, and other resources to enhance financial literacy.

User-Friendly Interface:

- Simple Navigation: An intuitive interface makes it easy for users to access and use all features.

- Mobile Access: Available on mobile devices, allowing users to manage their finances on the go.

Cost-Effectiveness

Affordable Subscription Plans:

- Low Monthly Fees: Subscription plans are typically inexpensive, often starting at around $10 to $20 per month.

- Comprehensive Services: For a low fee, users get access to a wide range of credit and financial management tools.

No Hidden Costs:

- Transparent Pricing: Clear and straightforward pricing with no hidden fees.

Free Trials and Discounts:

- Risk-Free Trials: Many services offer free trial periods so users can test the platform without financial commitment.

- Discounts and Promotions: Occasional discounts and promotions make the service even more affordable.

Refresh.me provides an easy and cost-effective way to improve credit scores and overall financial health through credit monitoring, budgeting tools, personalized advice, and a user-friendly interface.

One of the most significant benefits of Refreshme is the real-time updates you’ll receive on your credit score. With Refreshme, you can be confident that you’re always up-to-date on your credit score, so you can take action quickly if you notice any changes. Plus, Refreshme will alert you if there are any changes to your credit report, such as new accounts or inquiries.

But Refreshme doesn’t just help you stay informed. It also helps you stay protected. With Refreshme, you’ll receive alerts if there are any suspicious activities or potential fraud attempts on your credit accounts. This early warning system can be invaluable in preventing identity theft and other financial crimes.

Of course, if you do run into any issues with your credit report, Refreshme has you covered. You’ll have access to a dedicated team of credit experts who can help you navigate any issues that may arise. Whether you need help disputing an error on your credit report or simply need advice on how to improve your credit score, the Refreshme team is there to support you every step of the way.

Overall, Refreshme credit monitoring is a powerful tool that can help you protect your financial future. Whether you’re looking to buy a new car, apply for a mortgage, or simply want to stay on top of your finances, Refreshme has everything you need to succeed. So why wait? Sign up for Refreshme today and start taking control of your credit score!

How DisputeBee Helps Improve Credit

- Automated Dispute Process:

- DisputeBee automates the process of generating dispute letters. Users can quickly create and send letters to credit bureaus to dispute inaccurate or unfair items on their credit reports.

- User-Friendly Interface:

- The platform is designed to be user-friendly, even for those with little to no experience in credit repair. It guides users through each step, making the process straightforward.

- Customizable Templates:

- DisputeBee offers customizable dispute letter templates that can be tailored to specific credit issues, increasing the chances of successful disputes.

- Educational Resources:

- The platform provides educational resources to help users understand their credit reports and the dispute process, empowering them to take control of their credit health.

- Tracking and Management:

- Users can track the status of their disputes through the platform, ensuring they stay informed about the progress and outcomes.

Cost-Effectiveness

- Affordable Subscription Plans:

- DisputeBee offers subscription plans that are significantly more affordable than hiring a traditional credit repair service. Plans typically range from around $20 to $40 per month, depending on the level of service required.

- No Hidden Fees:

- Unlike some credit repair companies that may have hidden fees or additional charges, DisputeBee provides clear and transparent pricing, so users know exactly what they’re paying for.

- Cost Savings:

- By using DisputeBee, individuals can save money compared to hiring a credit repair agency, which can charge hundreds or even thousands of dollars for similar services.

- Free Trial or Money-Back Guarantee:

- DisputeBee often offers a free trial period or a money-back guarantee, allowing users to try the service without financial risk.

Dispute Bee Credit Repair Software offers a range of features designed to help users take control of their credit scores. Its easy-to-use interface simplifies the credit repair process, enabling users to dispute errors and inaccuracies with ease. The software also provides personalized advice and guidance on how to improve credit scores and maintain a healthy credit profile.

Furthermore, Dispute Bee Credit Repair Software offers real-time updates on the status of disputes, enabling users to monitor progress and stay informed throughout the credit repair process. The software also provides access to legal templates and documents, making it easy for users to draft effective dispute letters and communicate with creditors and bureaus.

Overall, Dispute Bee Credit Repair Software is an essential tool for anyone looking to improve their credit scores and achieve financial stability. With its powerful features, intuitive interface, and comprehensive support, Dispute Bee Credit Repair Software is the ultimate solution for repairing and maintaining a healthy credit profile.

Benefits

Credit Monitoring:

- Real-Time Alerts: Provides real-time alerts for any changes in your credit report.

- Detailed Reports: Regular access to comprehensive credit reports.

Identity Theft Protection:

- Fraud Alerts: Monitors for signs of identity theft and alerts you immediately.

- Insurance: Offers insurance to cover expenses related to identity theft recovery.

Financial Tools:

- Credit Score Tracker: Tracks your credit score over time, helping you understand the impact of financial decisions.

- Budgeting Tools: Helps you create and manage budgets to improve financial health.

User-Friendly:

- Easy Navigation: Simple and intuitive interface for easy access to all features.

- Mobile Access: Manage your credit and financial health on the go.

Cost-Effectiveness

Affordable Plans:

- Low Monthly Fees: Subscription plans typically start at around $10 to $30 per month.

- Comprehensive Services: Includes credit monitoring, identity theft protection, and financial tools.

No Hidden Fees:

- Transparent Pricing: Clear and straightforward pricing with no hidden costs.

Free Trials and Discounts:

- Risk-Free Trials: Many services offer free trial periods for new users.

- Promotions: Occasional discounts and promotions make the service even more affordable.

IdentityIQ is an efficient and affordable solution for improving your credit score and financial health, offering real-time credit monitoring, identity theft protection, financial tools, and a user-friendly interface.